After

the Fed’s latest 2-day policy meeting it announced on Wednesday that it would

continue its $85 billion per month asset purchase program. The major indices fluctuated from positive to

negative throughout the day, as is typical of a Fed meeting day, before closing

basically unchanged.

Many

investors wonder why the Fed’s QE3 program hasn’t boosted the economy more than

it has. After all, $85 billion in

monthly asset purchases would be, in a normal economy, inflationary. This isn’t a normal economy, however, and as

we’ve argued many times in past commentaries the deflationary long-term cycles

which are down through 2014 is one reason why inflation remains subdued despite

the Fed’s best efforts.

There’s

another reason why QE3 hasn’t stimulated the economy to the extent that

Keynesians would like to see. It’s just

possible, as one respected economist has suggested, that quantitative easing

was never meant to be stimulative to begin with.

Scott

Grannis, a former chief economist at Western Asset Management and editor of the popular Calafia Beach Pundit

blog, recently wrote that the primary objective of QE was to satisfy the world’s

massive demand for money in the wake of the 2008 credit crash. With the very real prospect of runaway

deflation following the 2008 crisis, the Fed had no choice but to provide as

much liquidity to the financial system as it possible could. This, after all, is the prime object of the

central banks as Grannis points out.

Cash

is king in a deflationary environment, and following the credit crisis the

demand for money exploded as investors liquidated stocks and commodities in a

frantic bid to raise cash. “Strong

demand for T-bills began early in 2008,” observed Grannis. “From late 2007 through mid-2008, the Fed

sold almost its entire holdings of T-bills—about one-third of the Monetary

Base—in an attempt to satisfy the world’s demand for safe assets. But it wasn’t

enough.”

That’s

when bank reserves came to the rescue. Reserves

have since expanded to record levels and although banks are starting to lend

again, most of that surplus money remains unused. As Grannis puts it, “Bank reserves are the

new T-bills, and that's why banks have been content to accumulate $1.9 trillion

of ‘excess’ bank reserves (reserves that are sitting idle at the Fed, and not

being used to support increased lending) since late 2008.

Notwithstanding

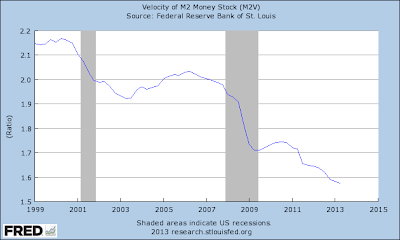

the massive increase in bank reserves, money supply as measured by M2 hasn’t

shown an inflationary increase. Velocity

of M2 is in decline and while a record amount of liquidity now exists, little

of that money is seeing the light of day.

See graph below.

Indeed,

the world currently holds 25% more money relative to total spending compared to

six years ago, according to Grannis. He

observes that QE did nothing more than provide banks with the ability to

support the public voracious appetite to hold more money. The excess money created by the Fed, in other

words, has been absorbed in a global savings glut fueled by fear and

uncertainty over the future. This is why

QE hasn’t resulted in the major inflation that many predicted.

True

economic inflation, which is characterized by dramatically rising prices, wages

and rising interest rates, only happens when the supply of money outstrips the

supply of money. So far that hasn’t

happened due to the world’s continued high demand for money. The Fed simply hasn’t been able to churn out

enough money supply to exceed the public’s clamor for it. This in itself is a testament to the

deflationary undercurrents due to the Kress cycles.