Gold recently fell to its lowest level in seven-and-a-half months

as the dollar rose to a 14-month high.

Easing tensions in Ukraine and the Middle East also acted as a drag on

gold and silver prices. Investors have

been asking the obvious question as to whether gold can recover from here and

if a bottom of at least short-term duration is imminent?

Dollar strength has been especially hard on the precious metals of

late. Commodity prices in general have

been beaten up in recent weeks by the surging U.S. dollar index, as sagging

gold and silver prices attest.

Both the U.S. dollar and commodity prices in general are largely

determined by the relative strength of the U.S. economy. With the economic recovery now in its fifth

year, investors (especially foreign ones) are increasingly attracted to the

U.S. as a safe haven. Economic weakness

in the euro zone has galvanized a flow of “hot” foreign money to the U.S. dollar,

further bolstering the dollar while at the same time depressing commodity

prices.

Along with a strong dollar, another reason for the recent weakness

in the gold ETFs has been a curious plunge in the level of short interest. For instance, the iShares Gold Trust (IAU) was

the target of a large decline in short interest during the month of August

despite a weak price trend.

As of August 15th, IAU short interest totaled

1.19 million shares, which represents a decline of 48 percent from the July 31

total of 2.29 million shares, according to Stock Ratings Network.com. Based on an average trading volume of 2.19

million shares, the days-to-cover ratio is currently 0.6 days.

Meanwhile ETF holdings for gold have continued to shrink with preliminary

data for August revealing an outflow of 11 tons and flows in September have

started the month off on a negative note at nine tons.

Earlier we examined the Market Vectors Russia ETF (RSX) for signs

of a technical breakdown in Russia’s stock market. A plunge in the RSX below the low from early

August would suggest turmoil ahead for Russia on the Ukraine front, which in

turn would be a major catalyst for gold bulls to charge. Lately, however, RSX has remained well above

the August bottom as the cease-fire talk between Ukraine and Russia has gained

momentum. As you can see in the

following chart, RSX is now well above its August low of 23.00 and has bought

itself at least a temporary reprieve. In

turn, gold and silver have suffered as the safe haven trade unwinds.

More than perhaps any other factor, gold has been at the mercy of

the macro environment, as Barclays recently observed. News from around the world hasn’t done the

gold price any favors lately as the yellow metal continues to search for a

much-needed fear catalyst.

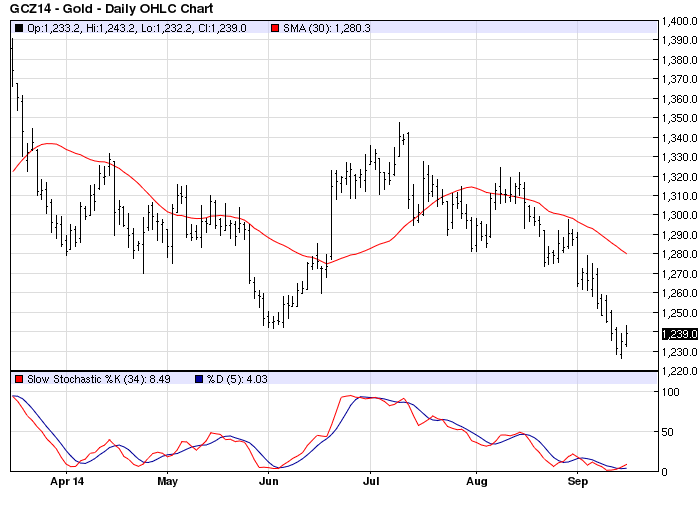

The December gold futures price has under-extended from the 30-day

moving average by nearly 4 percent as of last week. This is significant since a long-term

research history of gold shows that whenever price extends by approximately 4

percent +/- above or below the 30-day MA, a technical reversal usually follows

shortly thereafter. Gold is technically

oversold on a short-term basis and is therefore vulnerable to a relief rally in

the upcoming days. The extent and magnitude

of the next relief rally, however, will depend in large measure on either a

large short interest (which apparently doesn’t exist right now) or else buying

interest among institutions and hedge funds looking for bargains.